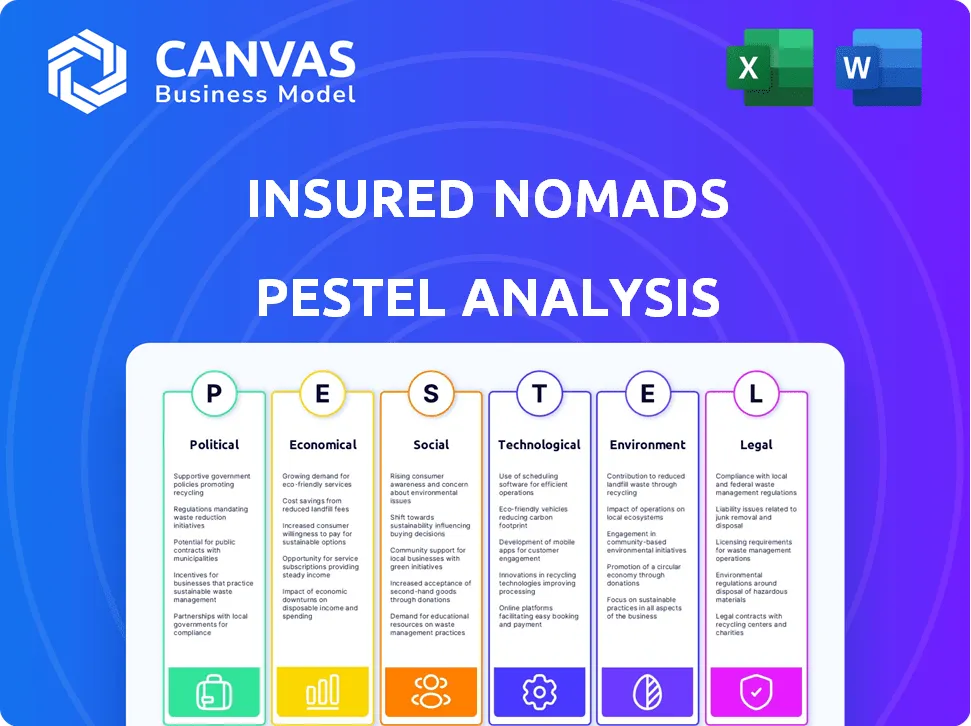

In an era defined by rapid transformation, Insured Nomads stands at the forefront, offering advanced-tech-enabled protection tailored for the future of work and travel. But what external factors are at play in shaping this innovative company's landscape? Through a comprehensive PESTLE analysis, we delve into the intricate political, economic, sociological, technological, legal, and environmental dynamics that impact their operations. As we unearth these interconnected elements, you'll gain a deeper understanding of how Insured Nomads navigates challenges and seizes opportunities in an ever-evolving environment. Dive in to discover more!

PESTLE Analysis: Political factors

Global political stability affects travel patterns.

The political stability of a country directly impacts travel patterns. According to the Global Peace Index 2023, countries such as Iceland and New Zealand ranked the highest in peace, with scores of 1.1 and 1.5 respectively, fostering higher inbound tourism and business travel. In contrast, countries like Afghanistan (score of 3.7) and Syria (score of 3.6) are considerably less stable, which results in decreased travel patterns. In 2022, international tourist arrivals were estimated at 1.4 billion, a reflection of how geopolitical factors influence travel trends.

Immigration policies impact expatriate services.

Immigration policies significantly shape expatriate services, particularly in key markets such as the United States and European Union countries. The United States issued approximately 4 million work visas in 2021, while the EU's Blue Card scheme provides work and residence permits for highly skilled non-EU nationals. In 2022, 11 member states of the EU reported a net immigration gain, reflecting a growing trend toward accepting expatriates. According to the OECD, the global migration of skilled workers was estimated at over 250 million individuals as of 2023, underscoring the necessity for adaptable expatriate services.

Support for remote work legislation.

Globally, legislative support for remote work has gained traction, with countries like Estonia, which announced a digital nomad visa in 2020, offering a pathway for remote workers. As of 2023, over 30 countries have enacted legislation to accommodate remote work arrangements. In a survey by Gallup in 2022, 54% of workers indicated that they would choose to work remotely if afforded the option, highlighting the growing demand for such policies.

Trade agreements influence operational costs.

Trade agreements play a crucial role in determining operational costs for businesses. The United States-Mexico-Canada Agreement (USMCA) reduced tariffs on goods between the three countries, promoting trade efficiency. In 2021, U.S. exports to Canada were valued at $332 billion, while imports from Canada totaled $256 billion. Additionally, the Regional Comprehensive Economic Partnership (RCEP), launched in January 2022, represents 30% of the global GDP, affecting multinational operational costs significantly due to reduced tariffs across member states.

Political risks in certain travel destinations.

Political risks can deter travel to certain destinations, affecting insurance provisions and expatriate services. According to the World Economic Forum's 2023 report, regions such as Sub-Saharan Africa experience higher political risk levels, evidenced by their volatility scores of up to 0.7 on a 1.0 scale, which can lead to decreased traveling and associated risks. Additionally, the International SOS reports that over 20 countries are currently listed as "high-risk" due to political instability, impacting travel insurance premiums and services.

| Country | Global Peace Index Score (2023) | Net Immigration (2022) | Work Visa Issued (2021) |

|---|---|---|---|

| Iceland | 1.1 | N/A | N/A |

| United States | 2.5 | Approximately 4 million | 4 million |

| Estonia | 1.9 | N/A | N/A |

| Afghanistan | 3.7 | N/A | N/A |

[cbm_pestel_top]

PESTLE Analysis: Economic factors

Economic downturns affect travel expenditure.

In 2020, as a direct result of the COVID-19 pandemic, global international tourist arrivals decreased by 74%, with an estimated loss of $1.3 trillion in export revenue from tourism. This demonstrates a clear impact of economic downturns on travel expenditure.

Currency fluctuations impact service pricing.

According to the International Monetary Fund (IMF), as of 2023, the US dollar has strengthened by approximately 6.5% against a basket of major currencies, such as the Euro and the British Pound. This fluctuation can lead to increased pricing for international services provided by companies like Insured Nomads, as their costs are often dependent on the currencies of various markets.

Rise of gig economy increases demand for protection.

In 2022, it was reported that the gig economy contributed approximately $450 billion to the U.S. GDP. The number of gig workers in the U.S. reached around 59 million in 2021, indicating a growing market for protection services tailored to independent contractors and remote workers, thereby increasing demand for Insured Nomads' offerings.

Investment in technology boosts operational efficiency.

The global investment in insurtech has seen substantial growth, amounting to approximately $15.3 billion globally in 2021. This investment enhances technological capabilities, allowing companies like Insured Nomads to streamline operations, improve customer experience, and reduce overhead costs due to increased automation.

Globalization enhances market opportunities.

As of 2022, global trade reached approximately $28.5 trillion, indicating substantial market opportunities for companies like Insured Nomads. With the increase in cross-border workers and digital nomads, the globalization trend fosters a larger customer base looking for protection solutions.

| Economic Factor | Impact | Real-Life Data |

|---|---|---|

| Economic downturns | Reduction in travel expenditure | 74% decrease in international arrivals in 2020 |

| Currency fluctuations | Impact on pricing structure | 6.5% strengthening of USD against major currencies in 2023 |

| Rise of gig economy | Increase in demand for protection services | $450 billion contribution to U.S. GDP in 2022; 59 million gig workers in the U.S. |

| Investment in technology | Enhancement of operational efficiency | $15.3 billion global investment in insurtech in 2021 |

| Globalization | Expansion of market opportunities | $28.5 trillion in global trade as of 2022 |

PESTLE Analysis: Social factors

Growing trend of digital nomad lifestyle

The digital nomad population is estimated to have reached approximately 35 million in 2023, a significant increase from about 10 million in 2019. This lifestyle trend has been accelerated by the COVID-19 pandemic.

Increased concern for health and safety while traveling

A survey conducted in 2022 found that 78% of travelers consider health and safety a top priority, reflecting a sharp increase from 57% in 2019. Additionally, 45% of travelers indicated they would avoid destinations reporting high COVID-19 cases.

Cultural sensitivity in service offerings

According to cultural studies, 65% of travelers prefer companies that demonstrate cultural understanding and sensitivity. Furthermore, 70% of travel companies are now prioritizing cultural education as part of their training programs.

Demand for flexible work arrangements

Flexibility in work arrangements has become essential, with 83% of remote workers stating they prefer to work in a flexible environment. Additionally, 54% of employers reported that they are more likely to offer flexible working arrangements as a direct response to employee demands.

Generational shifts in attitudes towards travel

Research indicates that millennials and Gen Z travelers are more likely to spend on experiences, with 72% of millennials prioritizing travel over buying a house. A study revealed that 60% of Gen Z employees expect to work remotely while traveling, reflecting a shift towards a more transient lifestyle.

| Social Factor | Statistic/Percentage/Amount | Year |

|---|---|---|

| Digital Nomad Population | 35 million | 2023 |

| Travelers prioritizing health and safety | 78% | 2022 |

| Cultural sensitivity preference | 65% | 2023 |

| Workers preferring flexible arrangements | 83% | 2023 |

| Millennials prioritizing travel over housing | 72% | 2023 |

PESTLE Analysis: Technological factors

Advances in telecommunication enhance remote work.

The global telecommunication market reached a valuation of approximately $1.74 trillion in 2021, with projections to grow at a CAGR of 5.4% from 2022 to 2028.

According to a survey by Buffer in 2022, 97% of remote workers want to continue working remotely at least part-time.

Use of AI for risk assessment and customer service.

As of 2023, the AI market for risk management is expected to be valued at $6.45 billion, with a CAGR of 23.5% from 2023 to 2030.

In customer service, AI implementations have led to a reported 30% reduction in response times in various industries, including insurance.

Mobile applications improve service access.

Mobile apps have become critical, with over 3.5 billion smartphone users globally in 2023, according to Statista.

Furthermore, mobile applications account for 87% of total time spent on digital media.

Insured Nomads leverages this trend by providing a mobile application that facilitates travel insurance management for users on the go.

Big data analytics for personalized customer experience.

The big data analytics market size was valued at approximately $230 billion in 2020, and it is projected to reach $684 billion by 2029, growing at a CAGR of 13.2%.

Companies employing big data analytics have reported up to a 8-10% increase in revenue and improved customer retention rates, which are critical in the insurance sector.

| Factor | Value | Growth Rate / Impact |

|---|---|---|

| Telecommunication Market Value | $1.74 Trillion | 5.4% CAGR (2022-2028) |

| Remote Workers' Preference | 97% | N/A |

| AI Market for Risk Management | $6.45 Billion | 23.5% CAGR (2023-2030) |

| AI Impact on Response Times | 30% Reduction | N/A |

| Global Smartphone Users | 3.5 Billion | N/A |

| Mobile App Digital Media Time Share | 87% | N/A |

| Big Data Analytics Market Size | $230 Billion | 13.2% CAGR (2020-2029) |

| Revenue Increase from Big Data | 8-10% | N/A |

Cybersecurity measures critical for online transactions.

The global cybersecurity market size was valued at approximately $173 billion in 2022 and is projected to reach $266 billion by 2027, growing at a CAGR of 9.7%.

In 2021, cyberattacks led to losses exceeding $6 trillion globally, emphasizing the need for robust cybersecurity measures within the insurance technology landscape.

According to a survey by IBM, the average cost of a data breach in 2022 was around $4.35 million.

PESTLE Analysis: Legal factors

Compliance with international travel regulations

The regulatory landscape for international travel is continuously evolving. In 2021, the global travel industry faced over $1 trillion in losses due to restrictions caused by the COVID-19 pandemic, highlighting the importance of compliance with travel regulations. Countries implemented various entry requirements, including proof of vaccination, testing, and quarantine mandates. For instance, as of 2023, the European Union requires travelers from non-member states to comply with specific entry regulations, impacting insurance coverage and client adaptability.

Data protection laws affect customer information handling

Insured Nomads must navigate stringent data protection laws, such as the General Data Protection Regulation (GDPR), which imposes fines up to €20 million or 4% of a company’s global revenue, whichever is higher. In 2022, the average cost of a data breach for companies was estimated at $4.35 million. Additionally, various countries are enacting their own data protection standards, including the California Consumer Privacy Act (CCPA) in the U.S., which gives consumers more control over their personal data.

Legal requirements for insurance products vary by country

Insurance products are subject to a variety of legal standards, varying by country. In the European market, insurance companies must comply with Solvency II regulations, which require insurers to hold sufficient capital to cover potential claims. In 2021, insurance market size in Europe was approximately $1.24 trillion. In contrast, in emerging markets like India, insurance penetration stands at around 4.2% as of 2021, compared to 11.5% in developed markets. This disparity necessitates a tailored approach to meet varying legal requirements across jurisdictions.

Liability issues related to remote work scenarios

As remote work becomes more prevalent, liability issues have emerged. A survey conducted in 2022 found that 60% of employers in the U.S. expressed concern over potential liabilities arising from remote work scenarios. Additionally, 25 states have enacted laws addressing liability related to remote work in some capacity, leading to complexities in insurance coverage and risk management. In a 2023 report, insured liabilities across remote workers were estimated at over $3 billion annually.

Intellectual property protection for proprietary technology

Insured Nomads must prioritize the protection of its proprietary technology. Globally, intellectual property theft costs companies an estimated $600 billion each year. According to the U.S. Patent and Trademark Office, the number of patents granted in 2022 was about 360,000, reflecting the competitive landscape for technology-driven companies. Insured Nomads should consider investment in IP protection strategies, estimated to cost around $50,000 to $250,000 annually depending on the complexity of the technology and markets involved.

| Country | Insurance Penetration Rate | Major Regulations | Data Privacy Law Compliance Costs |

|---|---|---|---|

| United States | 11.5% | CCPA | $4.35 million |

| Germany | 10% | Solvency II | €20 million |

| India | 4.2% | Insurance Act 1938 | Variable |

| France | 9% | Insurance Code | €20 million |

| Australia | 8% | Insurance Contracts Act 1984 | Variable |

PESTLE Analysis: Environmental factors

Climate change impacts travel safety and policies

According to the World Meteorological Organization, global temperatures have risen by approximately 1.2°C since the late 19th century, resulting in increased extreme weather events. Consequently, insurers face losses averaging between $30 billion and $70 billion annually due to climate-related disasters. The enhanced frequency of hurricanes, wildfires, and floods can directly jeopardize the safety of travelers, prompting insurance providers to adapt policies to include new risks.

Increasing demand for sustainable travel solutions

A survey conducted by Booking.com in 2022 revealed that 81% of travelers want to stay at least once in a sustainable accommodation. Additionally, the global sustainable travel market is projected to grow from $445 billion in 2021 to over $1 trillion by 2026, demonstrating a significant shift toward environmentally friendly travel choices.

Regulatory pressures for carbon footprint reduction

In 2021, the International Air Transport Association (IATA) set a goal to achieve net-zero carbon emissions by 2050. Further, various countries are implementing stricter regulatory frameworks to reduce greenhouse gases; for example, the European Union's Green Deal aims to lower emissions by 55% by 2030. Compliance costs for companies can reach up to €1 trillion over the next decade.

Natural disasters affect travel availability

The Economic Commission for Latin America and the Caribbean (ECLAC) reported that natural disasters resulted in economic losses totaling over $25 billion in 2020 alone. Such disasters lead to significant disruptions in travel, impacting availability and increasing the demand for insurance products that cover travel cancellations and delays.

Emphasis on eco-friendly practices within the company

Insured Nomads actively promotes eco-friendly practices, illustrated by a commitment to offsetting their corporate travel emissions by investing in reforestation projects. The company aims to plant 10,000 trees by 2025, reducing their carbon footprint significantly. Furthermore, an internal audit showed that implementing these sustainable practices led to a cost savings of about $200,000 annually.

| Environmental Factor | Current Impact / Goal | Financial Implications |

|---|---|---|

| Climate Change | 1.2°C increase | $30-$70 billion annual losses |

| Sustainable Travel Demand | 81% seek sustainable options | $445 billion market expected growth |

| Regulatory Pressures | Net-zero by 2050 | €1 trillion compliance cost |

| Natural Disasters | $25 billion in 2020 losses | Increased insurance demand |

| Eco-friendly Practices | 10,000 trees by 2025 | $200,000 annual savings |

In conclusion, the PESTLE analysis of Insured Nomads reveals a landscape vibrant with opportunities and challenges. As the company navigates the complex political and economic terrains shaped by shifting currencies and evolving immigration policies, it must also remain responsive to the sociological trends driving the digital nomad phenomenon. Leveraging technological advancements will be critical in enhancing customer experiences and ensuring robust legal compliance across borders. Additionally, addressing the pressing environmental concerns will not only align with global priorities but also resonate with a clientele increasingly focused on sustainability. The path forward is one of agility and foresight, ensuring protection for the adventurous spirit while embracing the dynamics of modern work and travel.

[cbm_pestel_bottom]